By Vincent Diringer and Annabell Cox, March 2024

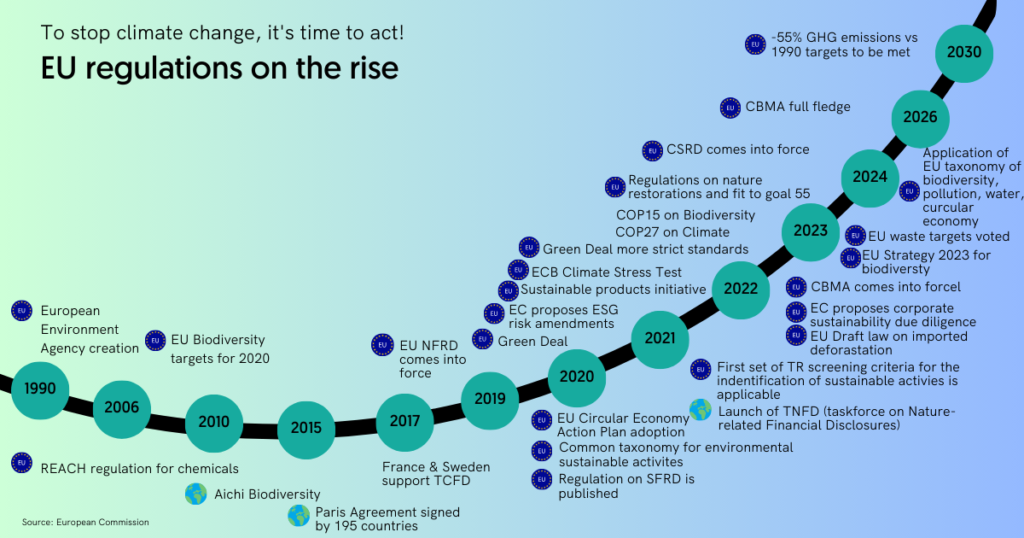

The journey of ESG reporting within the European Union traces back to the early 2000s when sustainability reporting was predominantly voluntary. Events such as the Exxon Valdez Oil Spill (1989), the Shell Brent Spar Controversy (1995) or the Rana Plaza Collapse (2013) to mention just major incidents, brought light to current business practices. These major disasters resulted in human and biodiversity loss as well as affected planetarian and human well-being for decades if not centuries. In response to growing concerns about the environmental and social impacts of business activities, the European Union (EU) began to introduce directives and regulations aimed at enhancing corporate transparency and sustainability performance. One landmark initiative was the introduction of the Non-Financial Reporting Directive (NFRD) in 2014, which mandated large European companies to disclose non-financial information, including ESG data, in their annual reports. This directive marked a significant step towards mainstreaming ESG reporting within the EU corporate landscape, driving companies to integrate sustainability considerations into their business strategies. At the same time, companies understood that lacking an environmental, social, and governance (ESG) strategy presents a major disadvantage for their business. In 2022, the European Union decided to enhance the reporting measures with the new reporting standards coming into force from January 1, 2024.

For a healthier planet and better business practices

Initially, the NFRD reporting rules applied to large public-interest companies with more than 500 employees. This covered approximately 11,700 large companies and groups operating within the European Economic Area (EEA), including listed companies, banks, insurance companies, and other firms designated by national authorities as public interest entities [1].

Today, part of the European Sustainability Reporting Directive (ESRD), the Corporate Sustainability Reporting Directive (CSRD) measures the sustainability impact of large companies and listed small and medium-sized enterprises (SMEs) including nearly 50’000 companies by 2029. Despite the fact, that the rules introduced by the NFRD remain in force, CSRD enhances transparency in the reporting and highlights the impact of its own business operations and value chain, its products and its business relationships. The exposure of these company aspects offers a detailed picture of how companies manage risks, how they affect the environment and how they contribute to social equality. Considering the remarkable change in our climate as well as geopolitical instabilities, time is precious. Despite the Paris Agreement and the relentless efforts in communicating the UNSDGs and the Agenda 2030, the world is lagging behind agreed targets. The EEA had to act quickly.

Developed by the European Financial Reporting Advisory Group (EFRAG), the CSRD proposes a double materiality assessment reviewing both the impact and financial materiality as well as the own operations and value chain. While impact materiality pertains to the material information about the firm’s impacts on people or the environment, financial materiality relates to the material information about risks and opportunities linked to a sustainability matter. [3] Equally, the entire organisational value chain and internal operations are taken under the loop. Instead of looking only at the supply chain, the value chain includes the full range of activities, resources and relationships related to the business and the external environment in which it operates. It encompasses the business activities, the product and business resources and relationships and looks at its products from conception to delivery, consumption and end-of-life. [4] The CSRD evaluates ESG matters where businesses impact everything from carbon emissions to waste management, governance, supply chains, community, workforce and consumers. Lastly, and the most painful as we know, the new directives go a step further. We can no longer report on statements without a proven data point and disclosures to confirm status, progress or deterioration of each reported aspect. Comprehensive, but also incredibly detailed, the EFRAG offers implementation guides to assist organisations with the implementation. For reference, we include the reference, should you wish to get more familiar with the information required: https://www.iasplus.com/en/news/2023/12/esrs-draft-ig

No doubt, the CSRD presents an uncomfortable challenge as any change we are facing in our lifetime. This directive though is essential to narrow the opportunity of greenwashing claims. It also forces a positive impact on many more businesses in the European Economic Area (EEA) than it did every before. Starting with some trial runs of CSRD reporting as of January 2025 for large and listed companies, more and more businesses will be gradually affected according to the timeline between 2025 and 2029.

Considering that the EEA remains at the forefront of climate action, these new instructions apply also to SMEs in non-EEA countries in the EEA such as Switzerland or the UK. For-profit organisations within Switzerland and branches for example in Germany must adhere to CSRD standards very soon. The involvement of the new rules is massive and important to get it right. To safeguard long-term competitiveness, the European Council delayed the sustainability reporting for certain sectors and third-country companies to June 2026. [2]

Despite the fact that the CSRD affects small and medium enterprises across Europe now or later, SMEs should start embracing sustainable practices today.

For sure, CSRD is painful for businesses, not only from an administrative perspective but also from a resource angle. But do we have a choice? How long can we continue with “business as usual”? Can SMEs still remain competitive with all these administrative constraints?

Burden or innovation?

As Plato once said: “Necessity is the mother of invention”. As much as the industrial revolution or digitalization did in the past, sustainability acts as a lens of innovation.

Smart businesses start to reflect now, using the time to innovate old processes, to explore sustainability practices within every aspect of their business and to assess and revise their purpose and vision embracing an equal society and a healthy planet. Identifying opportunities to improve ESG impact and their overall sustainability as early as possible allows businesses to gain an edge. Early compliance is something that saves businesses both time and money. By analysing the first set of CSRD reports that will be published, companies not yet within the scope have time to use the information to elaborate their strategy and also prepare themselves for their own reporting.

What’s in it for SMEs?

The evolution of ESG reporting within the European Union reflects a growing recognition of the interconnectedness between business activities and environmental and social impacts.

Since the creation of the European Environment Agency in 1990, the continuous expansion of renewable energies in Europe, the transition away from coal and continuous policy interventions allowed CO2 emissions to decrease by 30% in Europe [5] until the year 2022. However, with the current projection, the EEA forecasts to miss the reduction target of 55% in 2030. Equally, on the social aspect, where we need to create more equality in the workforce to secure equal and strong economies, the gender pay gap of average gross hourly earnings in the European Union reduced by 3.1% from 2010 to 2021 and we need to continue the effort. [6] While regulatory frameworks continue to evolve, the harmonisation of ESG reporting standards at the international level remains paramount to ensure consistency and comparability. By embracing transparency and accountability, companies not only mitigate risks but also harness opportunities for sustainable growth in an increasingly interconnected global economy.

At the same time, there is no Plan B, we cannot live on an overheated planet. Time is now to avoid the tipping point and contribute to returning to the planetary boundaries [7].

Together with our advisors and network of experts, LEAD-WiSE helps businesses to convert to sustainable practices with expertise in business innovation, sustainability frameworks and data-driven perspective. We review your status quo, your purpose and values, your internal operations, values chains, governance structure, and suppliers to become more effective and efficient as well as attractive to your clients, employees and investors by leading product innovation in addition to having a positive impact on society and the planet.

Contact us and embark on a quick diagnostic.

Key Takeaways

- Lagging an environmental, social, and governance (ESG) strategy presents a major disadvantage for their business.

- The Corporate Sustainability Reporting Directive (CSRD) measures the sustainability impact of large companies and listed small and medium-sized enterprises (SMEs) including nearly 50’000 companies by 2029, including you.

- CSRD is painful for businesses, not only from an administrative perspective, but also from a resource angle, but you can use it as your competitive edge and become more attractive to your clients, employees and investors by leading product innovation in addition to having a positive impact on society and the planet.

References

[1] European Commission, 2024, “Corporate sustainability reporting”.

[2] European Council, February 2024, Press release, Council and Parliament agree to delay sustainability reporting for certain sectors and third-country companies by two years

[3] Draft EFRAG IG1, Implementation Guidance, Materiality Assessment, December 2023

[4] Draft EFRAG IG2, Implementation Guidance, Value Chain, December 2023

[5] EEA 2023, Total net greenhouse gas emissions trends and projections Europe, December 2023

[6] Gender pay gap of average gross hourly earnings in the European Union from 2010 to 2021, Statista

[7] Planetary boundaries, Stockholm Resilience Centre, Stockholm University 2023